Has Tesla Already Won the Self-Driving Race?

The 5 hurdles a competitor must conquer to compete

In the near future, the Uber that picks you up won’t have a driver in it. AI will be in the driver’s seat.

Many people think the company with the best AI will win the self-driving race. However, AI is only one of many competencies needed for success. Winning is about taking a holistic approach through vertical integration and seeding an ecosystem. From this systems-thinking view, the clear winner is Tesla—by millions of miles.

Tesla’s ecosystem and its high level of vertical integration make it nearly impossible for any other company to compete on the road to robo-taxi commercialization. Here’s why this is so important…

The market opportunity for robo-taxis

Robo-taxis are poised to become one of the major technology disruptions in the history of humanity. ARK Invest estimates more than $11 trillion dollars of enterprise value will be created by robo-taxi companies by 2026. By these estimates, in only four years the entire sector will increase from $300B to $11.7T.

Why are electric cars so important for robo-taxi commercialization? Electric vehicles have over 50% lower maintenance costs than internal combustion (gas) cars, much lower refueling costs, and longer operational lifetimes. That’s why many companies are correctly pairing their self-driving efforts with electric cars.

How is Tesla in an unassailable lead? And, how can other companies compete?

The 1st hurdle: Geographic expansion of self-driving AI

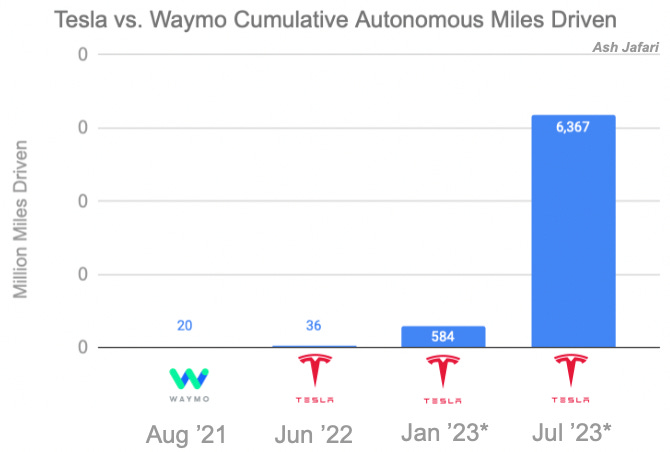

Right now, Waymo is operating in Phoenix and San Francisco, while Cruise is operating exclusively in San Francisco. On the other end of the spectrum, Tesla has more than 3 million vehicles on the road all over the world! Virtually all Tesla cars are equipped with self-driving hardware that gets a software update every month increasing capabilities.

Waymo and Cruise need to translate their AI systems from specific cities to make them applicable to other cities across North America, Europe, and China. Even with AI improvements, this seems like a monumental challenge to translate data from one city to another. Meanwhile, Tesla’s network is consolidating and intrepreting data from millions of miles driven every day.

Even if another company solves the problem of self-driving AI first, that is only the first hurdle to clear. There are four more to go!

The 2nd hurdle: Scaling battery production

If Waymo or Cruise hypothetically beat Tesla to solve the AI problem, they will then need an endless supply of one thing that’s in limited supply: batteries.

Back in the early 2010s, Tesla’s team started planning the build-out of a lower cost, small electric sedan. As they planned out their goal of 500,000 cars per year, they realized they would need more lithium-ion batteries than the entire world produced at the time.

In order to successfully launch a mass-production electrical vehicle, Tesla had to take the matter into their own hands. They went on to build one of the largest buildings in the world to mass-produce lithium-ion batteries: Gigafactory Nevada. Today, Tesla has 3 operational factories producing lithium-ion batteries and they’re about to finish the fourth in Germany.

Tesla is not only building massive gigafactories around the world, they have also signed contracts with every major battery manufacturer to essentially supplement the needs of their competitors! Even if Waymo or Cruise tried to produce 10 million electric cars, there likely won’t be enough battery supply for those cars.

Having a stronghold on the supply chain creates Tesla’s synergistic vertical integration letting them decide their own fate while lapping the competition.

If in some way, the other companies are able to successfully jump the first two hurdles, they will still be met with the third hurdle: mass production.

The 3rd hurdle: Producing millions of autonomous electric vehicles

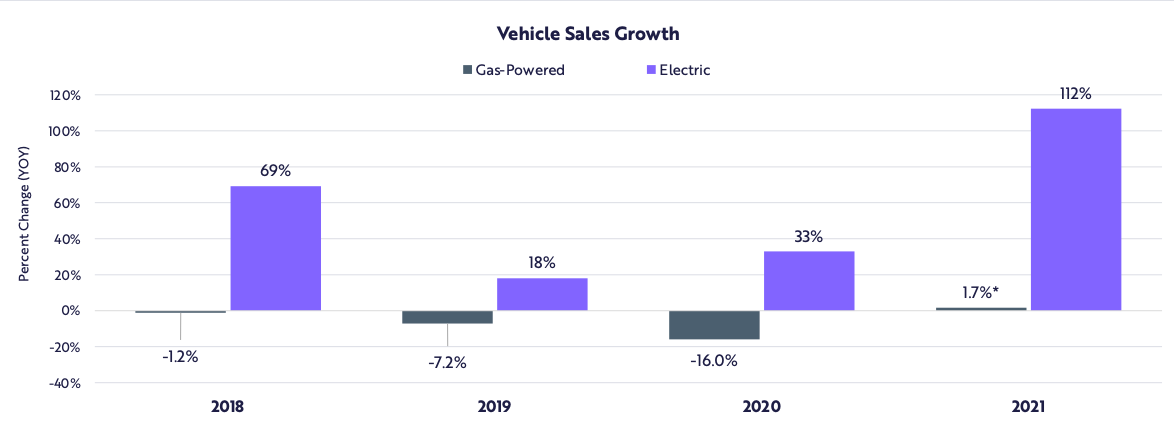

Only in this past year markets and the public have finally realized that electric vehicles are the future. As auto manufacturers scramble to secure battery capacity and produce electric vehicles, they are dealing with a huge issue. Much of the factory equipment used for internal combustion engines will not be usable in electric vehicle production. This means that billions of dollars will be lost to obsolete equipment. Moreover, auto manufacturers have already seen annual negative or flat growth for their internal combustion business.

Auto manufacturers are hemorrhaging money trying to keep their existing internal combustion business afloat. To add fuel to the fire, they have to spend tens of billions of dollars on new factories, new equipment, and securing battery capacity for an electric vehicle business—which won’t be profitable until they scale up.

Meanwhile, here’s Tesla manufacturing in a nutshell:

√ Battery capacity for millions of vehicles.

√ Industry-leading battery costs.

√ Factories capable of producing millions of electric vehicles per year.

√ Integration of self driving hardware at low-cost.

√ Industry-leading automotive margins.

How can Waymo compete? They would need their parent company, Alphabet, to buy a struggling manufacturer like Ford—which is already years behind in battery supply and infrastructure, and thus incapable of producing millions of electric vehicles anytime soon.

Even Cruise, which is a subsidiary of GM, can’t make this work. GM sold 25,000 electric cars in 2021, with 26 sold in Q4 2021. Yes—you read that correctly—only 26 cars sold! RIP GM.

The 4th hurdle: Be cost-competitive

As the tale goes, Elon Musk was examining a toy car one day when he realized it was stamped together in one step rather than assembled by hundreds of parts. He wondered why auto manufacturers weren’t doing the same.

In the last few years, Tesla has pioneered the technology that produces large sections of a car in a single casting. This meant going from 370 parts to just one. From 1,000 robots on the assembly line to 400. As a result, this has opened up a lot of physical space on the factory floor to produce even more cars. The single-cast car part is cheaper to make.

Check out Tesla’s automotive gross margins compared to the other auto manufacturers (below).

And here is a look at the automotive industry’s operating margins from the most recent quarter.

At this point, a competitor like Waymo would need to dramatically expand their full-self driving AI, scale up battery production, produce (and distribute) millions of electric vehicles, and do so in a cost-competitive way.

The four hurdles cleared by Tesla takes them to the finish line. But what if other companies are able to clear those very same hurdles?

The 5th hurdle: Tesla responds by cutting prices

Tesla’s lower battery costs and lower vehicle manufacturing costs would help them undercut the competition. Tesla can mass produce cars at price points where others would operate at a loss.

For example, a competitor might sell a car for $40,000 that costs $35,000 to make. For Tesla, it might cost $29,000 to make that same car. Thus, Tesla could price their vehicle at $32,000 coming in under the competition’s price and still operating above margin. Tesla wins again.

Suppose the competitor continues operating at a loss in the short term with the hope that it will eventually turn a profit in the long term. Would you pay $32K for a car that doesn’t receive regular software updates or lacks a supercharger network? Or, would you pay the same price for a Tesla that has better range and more features?

I would surmise that just like today, Tesla would capture 80%+ of the market share due to its leading products, supercharger network, brand affinity, and its entire ecosystem.

Winning the self-driving race

Finally, let’s say a competitor is able to tackle all those five hurdles. Will Tesla be left in the dust?

No. At the end of the day, the robo-taxi market is so large that even if competition splits among several companies each taking a 25% share that would create $3 trillion in enterprise value for each company in 2026.

Robo-taxis are part of the AI-job suite I discussed in my prior posts. They are replacing the human workforce with the AI workforce. In this case, it will not only be jobs like Uber drivers and truck drivers that will be displaced, but it will affect every commuter who slogs through hours of traffic each week. They will be the first true consumer robot and a great help to us all.

I hope this systems thinking approach has helped you understand more about the self-driving market. Contrary to popular belief, it’s not just an engineering problem where the better self-driving AI wins. Tesla has built an integrated ecosystem to address this multi-faceted problem making it extremely difficult for other companies to compete.

Up next, we will look at another AI-powered robot. The Tesla Bot. All this and more coming up in the weeks ahead. See you in the future!

💁🏻♂️ Disclaimer: All content on this Substack is for discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation to buy or sell any securities. Should you need such advice, consult a licensed financial or tax advisor. All views expressed are personal opinion as of date of publication and are subject to change without responsibility to update views. No guarantee is given regarding the accuracy of information on this Substack. Neither author or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

Interesting, concise information. Looking forward to more on robo-taxis...

These are really good Ash, please continue this Newsletter.